In today’s fast-paced business environment, small businesses need efficient and reliable financial software to manage their finances effectively. From bookkeeping to invoicing and payroll, the right financial tools can save time, reduce errors, and provide critical insights into your business’s financial health. With the plethora of options available, choosing the best finance software for your small business can be overwhelming. Here, we present the top 10 best finance software for small businesses in the USA, each designed to cater to various needs and preferences.

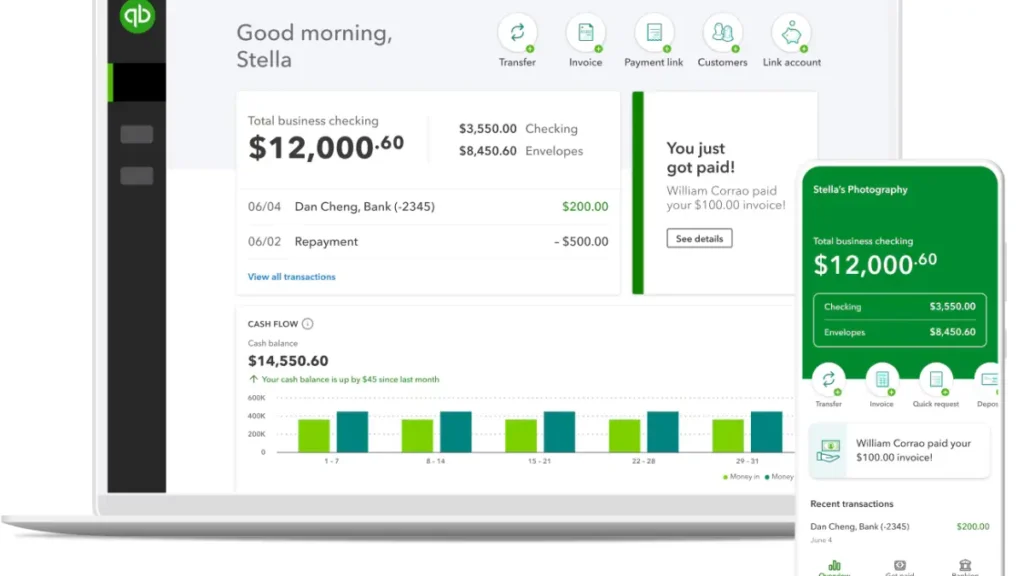

1. QuickBooks Online

QuickBooks Online is a popular choice among small businesses due to its comprehensive features and user-friendly interface. It offers:

- Bookkeeping and Accounting: Automated bookkeeping, expense tracking, and accounting features.

- Invoicing and Payments: Create and send invoices, accept online payments, and manage accounts receivable.

- Reporting: Customizable financial reports to monitor the business’s financial performance.

- Integration: Connects with numerous third-party apps like PayPal, Shopify, and more.

Read more –

2. Xero

Xero is known for its intuitive design and robust features, making it an excellent choice for small businesses. Key features include:

- Cloud-Based: Access your financial data from anywhere.

- Bank Reconciliation: Automatically import and categorize bank transactions.

- Invoicing: Create professional invoices and receive payments online.

- Payroll: Integrated payroll feature for easy employee payments.

Read more –

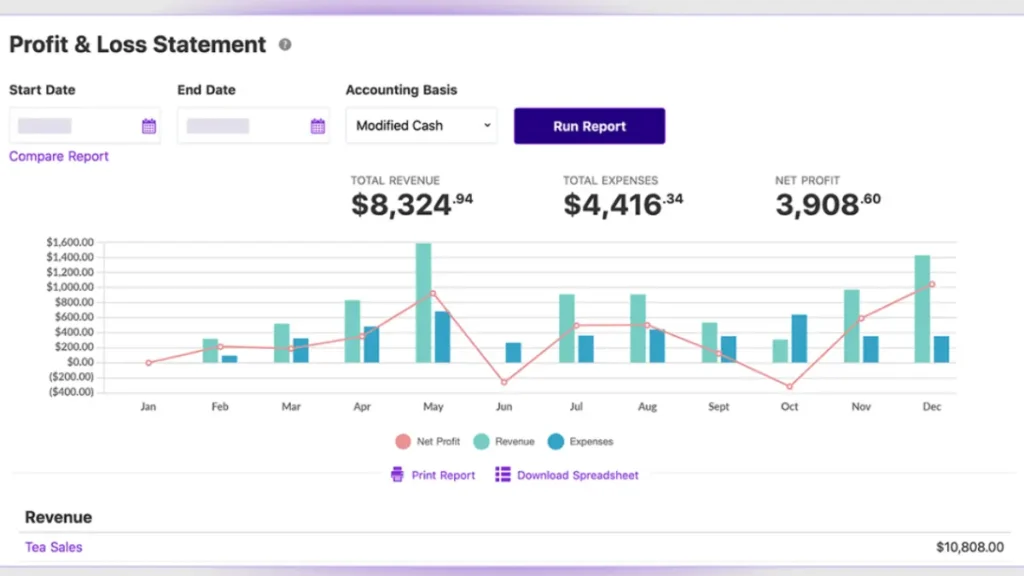

3. FreshBooks

FreshBooks is tailored for small businesses and freelancers looking for a simple yet powerful accounting solution. Highlights include:

- Time Tracking: Track billable hours and add them to invoices.

- Expense Management: Capture and categorize expenses effortlessly.

- Invoicing: Create, customize, and send invoices with ease.

- Project Management: Collaborate with team members and clients on projects.

Read more –

4. Zoho Books

Zoho Books offers a comprehensive suite of accounting tools designed for small businesses. Its features are:

- Automation: Automate workflows and manage repetitive tasks.

- Inventory Management: Track and manage inventory levels.

- Invoicing and Estimates: Create detailed invoices and estimates.

- Client Portal: Provide clients with a portal to view their transactions and pay invoices.

5. Wave

Wave is a free accounting software that offers robust features suitable for small businesses. Key offerings include:

- Invoicing: Professional invoicing capabilities with customizable templates.

- Accounting: Double-entry accounting with automatic transaction categorization.

- Receipts: Scan and manage receipts effortlessly.

- Payroll: Affordable payroll solutions for managing employee payments.

6. Sage Business Cloud Accounting

Sage Business Cloud Accounting is an ideal choice for growing small businesses. It provides:

- Invoicing and Payments: Create invoices and accept payments online.

- Cash Flow Management: Monitor and manage cash flow efficiently.

- Reporting: Generate financial reports for insights into business performance.

- Mobile App: Manage finances on-the-go with the mobile app.

7. Kashoo

Kashoo is a straightforward accounting software designed for small business owners who want simplicity. Its features include:

- Automated Bookkeeping: Automated transaction categorization and bank reconciliation.

- Invoicing: Create and send invoices quickly.

- Expense Tracking: Track expenses and upload receipts.

- Multi-Currency Support: Handle multiple currencies seamlessly.

8. OneUp

OneUp is an all-in-one accounting solution that caters to small business needs. It offers:

- Accounting and Bookkeeping: Automated bookkeeping and accounting features.

- Inventory Management: Manage inventory and stock levels.

- CRM: Integrated CRM to manage customer relationships.

- Sales and Purchases: Track sales orders and manage purchases efficiently.

9. AccountEdge Pro

AccountEdge Pro is a desktop accounting software that offers extensive features for small businesses. Key features include:

- Comprehensive Accounting: Full suite of accounting tools for financial management.

- Payroll: Integrated payroll solutions for employee payments.

- Inventory Management: Advanced inventory management capabilities.

- Time Billing: Track and bill for time spent on projects.

10. Patriot Software

Patriot Software is designed for small businesses looking for affordable and easy-to-use accounting and payroll solutions. Its features are:

- Accounting: Simple accounting tools for managing finances.

- Payroll: Comprehensive payroll solutions with tax filing services.

- Invoicing: Create and send professional invoices.

- Reporting: Generate financial reports for better business insights.

Conclusion

Choosing the right finance software is crucial for the success and growth of any small business. The options listed above provide a range of features and capabilities designed to meet the diverse needs of small businesses in the USA. Whether you are a freelancer, startup, or growing enterprise, investing in the right financial tools can streamline your operations, improve cash flow management, and provide valuable insights to drive your business forward. Evaluate your specific needs, compare the features, and select the software that best aligns with your business goals. With the right finance software, managing your small business finances can become more efficient, accurate, and hassle-free.