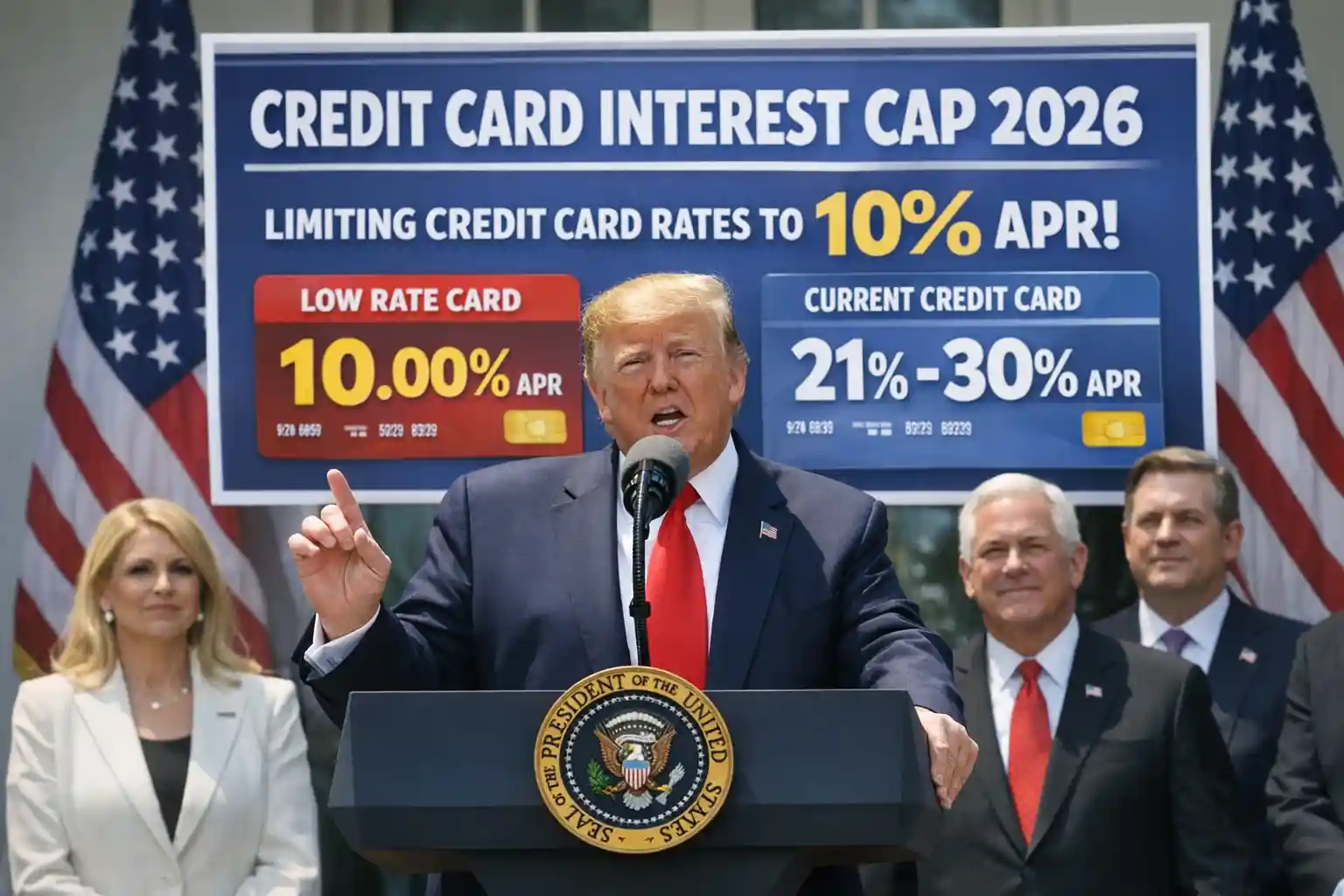

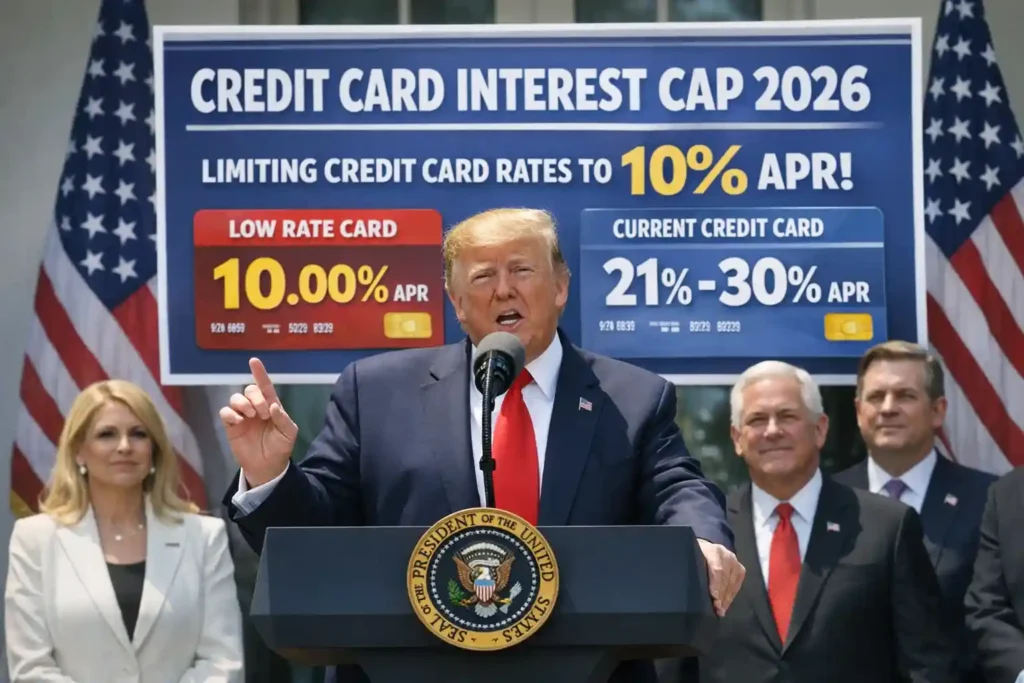

The Credit Card Interest Cap 2026 in the USA marks a turning point in consumer finance, reshaping how millions of Americans manage debt, credit, and financial planning. Announced by President Donald Trump, the proposal seeks to limit credit card interest rates to 10% APR, a dramatic reduction from the current average of 21–30%.

This initiative is designed to provide relief to households struggling with high-interest debt, offering a fairer system that prioritizes consumer protection over excessive bank profits. While banks argue that such a cap could reduce credit availability, cancel rewards programs, and impact airline partnerships, consumer advocates highlight the potential savings of billions of dollars annually for families and students.

Colleges and universities are also engaging with this debate, integrating the cap into financial literacy programs, business school case studies, and community college curricula to prepare the next generation for a regulated financial landscape. The cap’s impact extends beyond debt relief—it challenges traditional banking models, sparks innovation in fintech, and raises questions about long-term sustainability. For students, families, and professionals, understanding the credit card interest cap 2026 is essential to navigating the evolving U.S. economy.

What Is the Credit Card Interest Cap?

- Definition: A government-imposed limit on the maximum interest rate credit card companies can charge.

- Proposal: President Trump’s plan sets the cap at 10% APR, far below the current average of 21–30%.

- Goal: To reduce consumer debt burdens and prevent Americans from being “ripped off” by high-interest rates.

Why the Cap Matters

- Consumer Relief: Americans collectively owe over $1 trillion in credit card debt. A cap could save households billions in interest payments.

- Bank Resistance: Lenders argue that such a cap would force them to cancel millions of credit cards, reduce rewards programs, and tighten lending standards.

- Economic Ripple Effects: Airline loyalty programs, which rely heavily on credit card partnerships, could lose billions in revenue.

Impact on Colleges and Students

While the proposal directly targets banks, its ripple effects extend to colleges and universities, especially in the realm of financial literacy and student debt.

1. Financial Aid Offices

- Colleges often educate students about responsible credit use.

- A cap could change the way financial aid offices advise students, emphasizing low-interest borrowing options.

2. Business Schools

- Institutions like Harvard Business School, Wharton, and Stanford GSB will incorporate the cap into case studies on consumer finance, regulation, and banking strategy.

- Students will analyze how caps affect profitability, lending, and consumer welfare.

3. Community Colleges

- Community colleges play a vital role in teaching financial literacy.

- With a cap, curricula may shift toward understanding government regulation and its impact on personal finance.

4. Student Credit Card Programs

- Many colleges partner with banks to offer student credit cards.

- A cap could reduce the availability of such programs, forcing schools to rethink partnerships.

Colleges Leading Financial Literacy Efforts

Here’s how major U.S. colleges are engaging with the credit card interest cap discussion:

| College/University | Focus Area | Impact of Interest Cap |

|---|---|---|

| Harvard University | Business & Law | Case studies on regulation and consumer protection |

| University of Pennsylvania (Wharton) | Finance | Research on profitability of banks under capped rates |

| Stanford University | Economics | Policy analysis on long-term effects of caps |

| MIT | Technology & Finance | Exploring fintech alternatives to traditional credit |

| Community Colleges nationwide | Financial Literacy | Updating curricula to reflect capped interest rates |

Benefits of the Credit Card Interest Cap

- Lower Debt Burden: Students and families would pay less interest, freeing income for essentials.

- Encouragement of Responsible Borrowing: With lower rates, credit cards could become safer tools for building credit.

- Educational Opportunities: Colleges can use the cap as a teaching moment in economics, law, and finance.

Risks and Challenges

- Reduced Access to Credit: Banks may cancel cards for high-risk borrowers, including students.

- Impact on Rewards Programs: Airline miles and cashback offers could shrink, affecting partnerships with universities.

- Short-Term Nature: The proposal is for one year, raising questions about sustainability.

The Political Landscape

- Supporters: Progressives and consumer advocates argue the cap could save Americans $100 billion annually.

- Opponents: Banks and conservative economists warn of reduced credit availability and unintended consequences.

Brief Summery

The credit card interest cap is more than a financial policy—it’s a cultural and educational moment for the United States. If enacted, it would reshape consumer finance, challenge banks, and provide colleges with a real-world case study in regulation and economics.

For students, families, and educators, the cap represents both hope and uncertainty: hope for relief from crushing debt, and uncertainty about how banks and markets will adapt. As colleges integrate this debate into classrooms, the next generation of leaders will grapple with the balance between consumer protection and financial innovation.